Asia

EMEA

2023-03-20

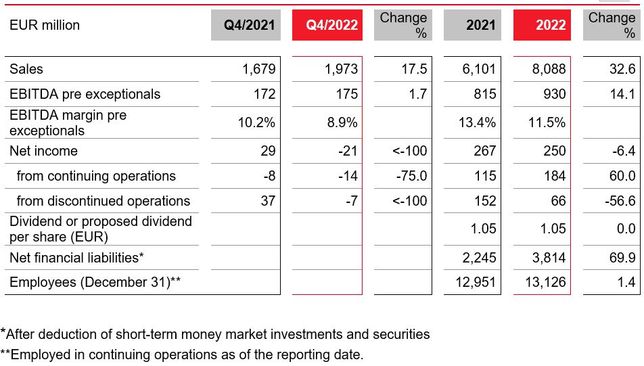

LANXESS increases sales and earnings significantly in fiscal year 2022

- Sales up 32.6 percent year-on-year at EUR 8.088 billion

- EBITDA pre exceptionals increase 14.1 percent to EUR 930 million

- Acquired Consumer Protection businesses make positive contribution

- Dividend proposal for fiscal year 2022: EUR 1.05 per share

- Guidance for fiscal year 2023: Earnings expected to be at the 2022 level

- Guidance for Q1 2023: EBITDA pre exceptionals of EUR 180 million to EUR 220 million expected

- CEO Matthias Zachert: “Our strategy has stood the test – LANXESS has successfully managed a year with many adversities.”

In an environment characterised by many upheavals, LANXESS closed fiscal year 2022 successfully. The specialty chemicals company’s sales and earnings have increased significantly.

Group sales amounted to EUR 8.088 billion in 2022, up 32.6 percent on the previous year’s figure of EUR 6.101 billion. EBITDA pre exceptionals increased by 14.1 percent to EUR 930 million compared with EUR 815 million a year earlier. Earnings were therefore within the recently forecast range of EUR 900 million to EUR 950 million.

LANXESS passed on the significantly increased costs for raw materials and energy to the market in full via a successful increase of selling prices. The growth was especially driven by the Specialty Additives and Consumer Protection segments. The latter benefited in particular from the contributions from IFF’s Microbial Control business acquired at the beginning of July 2022 and from the U.S. company Emerald Kalama Chemical acquired at the beginning of August 2021. Lower sales volumes, especially in the final quarter of 2022, had a negative impact on earnings.

“We mastered 2022 successfully and increased our earnings despite the adverse conditions. This shows that LANXESS is weatherproof. Our strategy has stood the test. Thanks to our products’ leading market positions, we passed on the extreme cost increases in full. In addition, we sharpened our focus on specialty chemicals and reinforced our presence in North America. This provides additional stability and growth,” says Matthias Zachert, CEO of LANXESS. “However, 2023 will not be easier. The reduced demand that we already felt in the final quarter of 2022 is currently continuing in the new year. But I am convinced that we will make it through this economic slump thanks to our stable positioning.”

The EBITDA margin pre exceptionals reached 11.5 percent, against 13.4 percent a year ago. The decline resulted from the passing on of significantly increased costs and lower sales volumes.

Net income from continuing operations increased considerably by 60.0 percent and amounted to EUR 184 million, against EUR 115 million a year ago. This does not include the results of the High Performance Materials business unit, which was spun off and reported as a discontinued operation.

For 2023, LANXESS expects EBITDA pre exceptionals to be at the level of the previous year. At the same time, the Group anticipates a recessionary business environment in the first half of the year. The persistently high energy prices from the fourth quarter of the previous year will also make an impact at the start of 2023. The repercussions of the war in Ukraine and changes in raw material and energy costs remain sources of uncertainty. For the first quarter of 2023, LANXESS expects EBITDA pre exceptionals of between EUR 180 million and EUR 220 million.

Portfolio optimized further

In the past year, LANXESS continued to sharpen its focus on specialty chemicals, thus becoming even more stable and less dependent on cyclical fluctuations. The Group completed the acquisition of the Microbial Control business from the U.S. company IFF in July 2022. In May last year, LANXESS also announced the spin-off of the High Performance Materials business unit. This is to be transferred to a joint venture for high-performance engineering polymers. LANXESS is planning to found this joint venture with private equity investor Advent International. Now that all antitrust approvals have been obtained, the founding of the joint venture is expected to be completed at the beginning of April. LANXESS will receive a payment of approximately EUR 1.1 billion from the transaction, which the Group will use primarily to reduce its debt and thus strengthen its balance sheet.

Dividend to remain stable

The dividend is expected to remain stable in 2022. The Board of Management and Supervisory Board will propose a dividend of EUR 1.05 per share to the Annual Stockholders’ Meeting, which will be held virtually on May 24, 2023. Despite a challenging environment, it is therefore unchanged year-on-year. The Group thus continues to follow its policy of at least keeping the dividend stable. The proposal would corresponds to a total distribution of around EUR 90.7 million.

Growth in all segments

The businesses in the Consumer Protection segment performed very positively throughout the year. The segment benefited to a high degree from the acquisitions of the company Emerald Kalama Chemical in 2021 and of the Microbial Control business from the company IFF in July 2022. Sales amounted to EUR 2.366 billion in fiscal year 2022, up 49.8 percent on the previous year’s figure of EUR 1.579 billion. EBITDA pre exceptionals increased by 30.1 percent to EUR 363 million compared with EUR 279 million a year earlier. All the segment’s business units achieved higher selling prices. Significantly higher freight costs had a negative influence on earnings. The EBITDA margin pre exceptionals decreased from 17.7 percent in the previous year to 15.3 percent.

In the Specialty Additives segment, too, LANXESS passed on the significantly increased energy and raw material prices via higher selling prices. The segment also benefited from the ongoing recovery in the aviation industry. Sales amounted to EUR 2.970 billion, up 29.4 percent on the previous year’s sales of EUR 2.295 million. EBITDA pre exceptionals grew by 48.3 percent from EUR 323 million in the previous year to EUR 479 million. The EBITDA margin pre exceptionals increased to 16.1 percent, against 14.1 percent a year ago.

In the Advanced Intermediates segment, LANXESS likewise successfully passed on the price increases for energy and raw materials. However, weaker demand and thus declining sales volumes led to a drop in earnings. Sales amounted to EUR 2.413 billion, up 23.8 percent on the previous year’s figure of EUR 1.949 billion. At EUR 291 million, EBITDA pre exceptionals was 12.6 percent lower than the previous year’s figure of EUR 333 million. The EBITDA margin pre exceptionals was 12.1 percent, against 17.1 percent in the previous year.

About LANXESS

LANXESS is a leading specialty chemicals company with sales of EUR 8.1 billion in 2022. The company currently has about 13,000 employees in 32 countries. The core business of LANXESS is the development, manufacturing and marketing of chemical intermediates, additives and consumer protection products. LANXESS is listed in the leading sustainability index Dow Jones Sustainability Index (DJSI World and Europe).

India, February 2024

Forward-Looking Statements

This company release contains certain forward-looking statements, including assumptions, opinions, expectations and views of the company or cited from third party sources. Various known and unknown risks, uncertainties and other factors could cause the actual results, financial position, development or performance of LANXESS AG to differ materially from the estimations expressed or implied herein. LANXESS AG does not guarantee that the assumptions underlying such forward-looking statements are free from errors, nor does it accept any responsibility for the future accuracy of the opinions expressed in this presentation or the actual occurrence of the forecast developments. No representation or warranty (expressed or implied) is made as to, and no reliance should be placed on, any information, estimates, targets and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions or misstatements contained herein, and accordingly, no representative of LANXESS AG or any of its affiliated companies or any of such person's officers, directors or employees accepts any liability whatsoever arising directly or indirectly from the use of this document.

Information for editors:

All LANXESS news releases and their accompanying photos can be found at http://press.lanxess.com. Recent photos of the Board of Management and other LANXESS image material are available at http://photos.lanxess.com.

You can find further information concerning LANXESS chemistry at http://lanxess.com/en/Media/Stories

Follow us on X (Twitter), Facebook, LinkedIn and YouTube:

http://www.x.com/LANXESS

http://www.facebook.com/LANXESS

http://www.linkedin.com/company/lanxess

http://www.youtube.com/lanxess

- Gallery